idaho sales tax rate

Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9. Find your Idaho combined state and local tax.

Payroll Software Solution For Idaho Small Business

The Idaho sales tax rate is currently.

. Cities with local sales taxes Contact the following cities directly for. Idaho has a 6 statewide sales tax rate but also has 116 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

The Boise sales tax rate is. The Idaho sales tax rate is currently. Idaho has reduced its income tax rates.

Depending on local municipalities the total tax rate can be as high as 9. The use tax rate is the same as the state sales tax rate. Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food.

The Moscow Idaho sales tax is 600 the same as the Idaho state sales tax. Did South Dakota v. Idahos sales tax is 6 percent.

The current state sales tax rate in Idaho ID is 6. The corporate tax rate is now 6. Did South Dakota v.

For individual income tax the rates range from 1 to 6 and the number of brackets have. Idaho has a statewide sales tax rate of 6 which has been in place since 1965. Local level non-property taxes are allowed within resort cities if.

31 rows Idaho ID Sales Tax Rates by City The state sales tax rate in Idaho is 6000. Wayfair Inc affect Idaho. Average Local State Sales Tax.

The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. While many other states allow counties and other localities to collect a local option sales tax Idaho does. A business might also owe use tax if it purchases.

The Boise Idaho sales tax is 600 the same as the Idaho state sales tax. With local taxes the total sales tax rate is between 6000 and 8500. Object Moved This document may be found here.

The County sales tax rate is. Retailers need a sellers permit to conduct retail sales. Prescription Drugs are exempt from the Idaho sales tax Counties and cities can charge an.

The 2018 United States Supreme Court. Non-property taxes are permitted at the local. The Idaho ID state sales tax rate is currently 6.

Maximum Possible Sales Tax. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0. Idaho State Sales Tax.

While many other states allow counties and other localities to collect a local option sales tax Idaho does not. The base state sales tax rate in Idaho is 6. Maximum Local Sales Tax.

Wayfair Inc affect Idaho. The Idaho Falls sales tax rate is. While many other states allow counties and other localities to collect a local option sales tax Idaho does.

The total tax rate might be as high as 9 depending on local municipalities. The County sales tax rate is. The 2018 United States Supreme.

Idaho Lawmakers Pitch Major Cut To Property Taxes Ktvb Com

How To Register For A Sales Tax Permit Taxjar

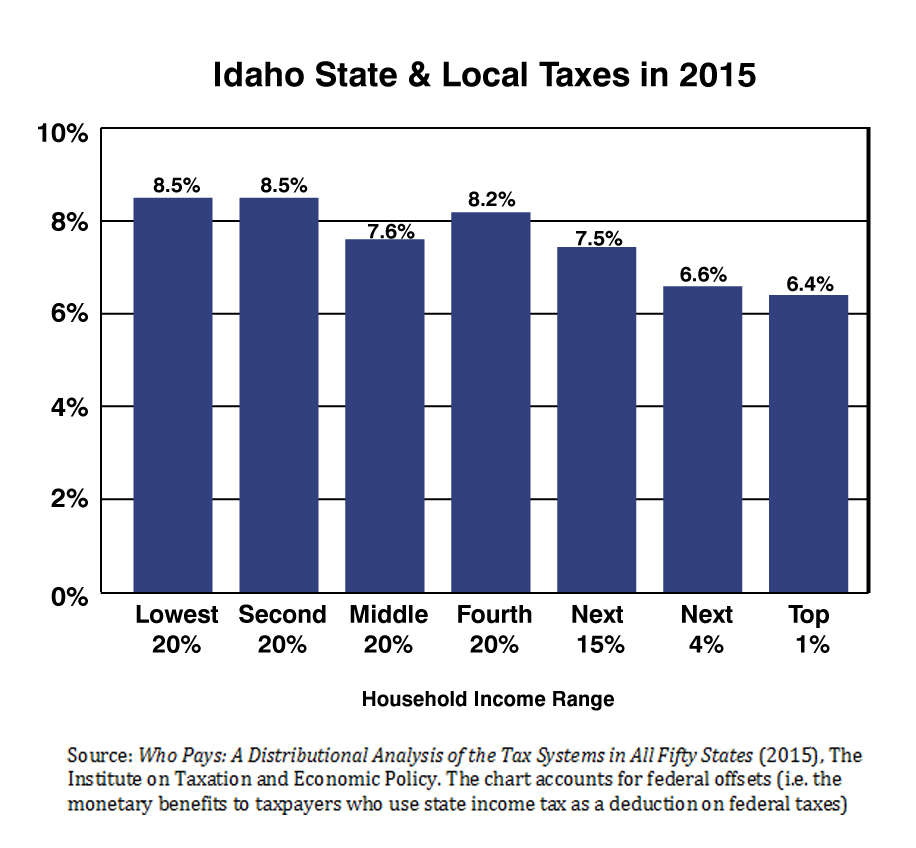

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

State Tax Levels In The United States Wikipedia

Idaho Gop Wants To Eliminate Property Taxes For Some Residents Increase Sales Tax Politics Magicvalley Com

A Summary Of Four Proposals From The Legislature S Tax Working Group Idaho Center For Fiscal Policy

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

General Sales Taxes And Gross Receipts Taxes Urban Institute

The Cost Of Living Battle Washington Vs Idaho Real Estate With Tazz

Idaho Corporate Tax Rate Decrease Enacted

Idaho Governor Signs Massive Tax Cut Education Bill

Idaho Sales Tax Rates By City County 2022

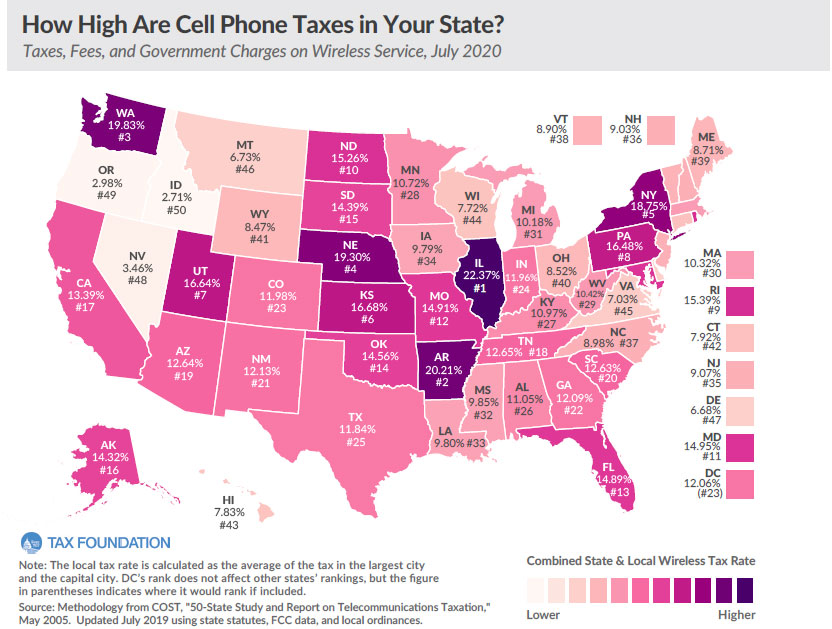

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

In Many States You Pay Sales Tax On Items You Buy This Sales Tax Is A Percent Of The Purchase Price A Tax Percent Is Also Called A Tax Rate A Desk